247 KiB

| Tag | Date | DocType | Hierarchy | TimeStamp | Link | location | CollapseMetaTable | |||

|---|---|---|---|---|---|---|---|---|---|---|

|

2022-10-28 | WebClipping | 2022-10-28 | https://www.bloomberg.com/features/2022-the-crypto-story/?ref=Weekly+Filet-newsletter | true |

Parent:: @News, Crypto Investments, @Investment master Read:: 2023-01-16

name Save

type command

action Save current file

id Save

^button-WhyDoesCryptoMatterNSave

Why Does Crypto Matter? Matt Levine on BTC, ETH, Blockchain

There was a moment not so long ago when I thought, “What if I’ve had this crypto thing all wrong?” I’m a doubting normie who, if I’m being honest, hasn’t always understood this alternate universe that’s been percolating and expanding for more than a decade now. If you’re a disciple, this new dimension is the future. If you’re a skeptic, this upside-down world is just a modern Ponzi scheme that’s going to end badly—and the recent “crypto winter” is evidence of its long-overdue ending. But crypto has dug itself into finance, into technology, and into our heads. And if crypto isn’t going away, we’d better attempt to understand it. Which is why we asked the finest finance writer around, Matt Levine of Bloomberg Opinion, to write a cover-to-cover issue of Bloomberg Businessweek, something a single author has done only one other time in the magazine’s 93-year history (“What Is Code?,” by Paul Ford). What follows is his brilliant explanation of what this maddening, often absurd, and always fascinating technology means, and where it might go. —Joel Weber, Editor, Bloomberg Businessweek

Featured in Bloomberg Businessweek, Oct. 31, 2022. Subscribe now.

I

Ledgers, Bitcoin, Blockchains

MODERN LIFE CONSISTS IN LARGE PART OF ENTRIES IN DATABASES.

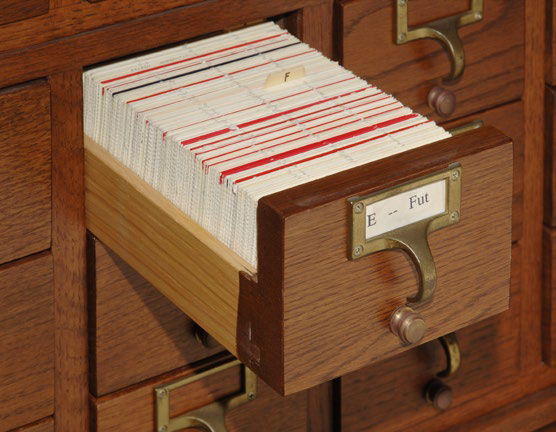

If you have money, what you have is an entry in your bank’s database saying how much money you have. If you have a share of stock, what you have is generally an entry on a list—kept by the company or, more likely, some central intermediary1—of who owns stock.

If you own a house, things are slightly different. There’s a house involved. But your ownership of that house is probably written down in some database; in the US this often means there’s a record of you buying the house—your title—in a filing cabinet in the basement of some county clerk’s office. (It’s not a very good database.) In many ways the important thing here is the house: You have a key to the front door; your stuff is there; your neighbors will be unsurprised to see you leaving the house in the morning and would be surprised to see someone else coming back in. But in many other ways the important thing is the entry in the database. A bank will want to make sure you have the title before giving you a mortgage; a buyer will want to do the proper procedures to that record before paying you for the house. The key will not suffice.

Lots of other stuff. Much of modern life occurs online. It’s not quite true that your social life and your career and your reputation consist of entries in the databases of Meta Platforms and Google and Microsoft, but it’s not quite false, either.

Some of this stuff has to do with computers. It’s far more convenient for the money to be computer entries than sacks of gold or even paper bills. Some of it is deeper than that, though. What could it mean to own a house? One possibility is the state of nature: Owning a house means 1) you’re in the house, and 2) if someone else tries to move in, you’re bigger than them, so you can kick them out. But if they’re bigger than you, now they own the house.

Another possibility is what you might think of as a village. Owning a house means you live there and your neighbors all know you live there, and if someone else tries to move in, then you and your neighbors combined are bigger than them. Homeownership is mediated socially by a high-trust network of peers.

Neighborhoods, where everybody knows your name.

A third possibility is what you might think of as a government. Owning a house means the government thinks you own the house, and if someone else tries to move in, then the government will kick them out.2 Homeownership is mediated socially by a government. The database is a way for the government to keep track. You don’t have to trust any particular person; you have to trust the rule of law.

Money is a bit like that, too. Sacks of gold are a fairly straightforward form of it, but they’re heavy. A system in which your trusted banker holds on to your sacks for you and writes you letters of credit, and you can draw on those letters at branches of the bank run by your banker’s cousin—that’s pretty good, though it relies on trust between you and the banker, as well as the banker and the banker’s cousin. A system of impersonal banking in which the tellers are strangers and you probably use an ATM anyway requires trust in the system, trust that the banks are constrained by government regulation or reputation or market forces and so will behave properly.

Saying that modern life is lived in databases means, most of all, that modern life involves a lot of trust.

WE TRUST THE KEEPERS OF THE DATABASES.

Sometimes this is because we know them and consider them to be trustworthy. More often it means we have an abstract sense of trust in the broader system, the system of laws and databases and trust itself. We assume that we can trust the systems we use, because doing so makes life much easier than not trusting them and because that assumption mostly works out. It’s a towering and underappreciated achievement of modernity that we mostly do trust the database-keepers,

and that they mostly are trustworthy.

B.

What If You Don’t Like It?

i. Distrust

But we don’t always trust them, and they’re not always trustworthy.

Sometimes they just aren’t. There are banks you can’t trust to hold your money for you and places where you can’t trust the rule of law to regulate them. There are governments you can’t trust not to seize your money from the banks, or falsify election results, or change the property registry and take your house. There are social media companies you can’t trust not to freeze your account arbitrarily. Most people in the US, most days, live in a high-trust world, where it’s easy and reasonable to trust that the intermediaries who run the databases that shape our lives will behave properly. But not everyone everywhere lives like that.

Even in the US, trust can be fragile. The 2008 financial crisis caused huge and lasting damage to a lot of people’s trust in the banking system. People trusted banks to do nice, safe, socially productive things, and it turned out they were doing wild, risky things that caused an economic crisis. After that it became harder for many people to trust banks to hold their savings.

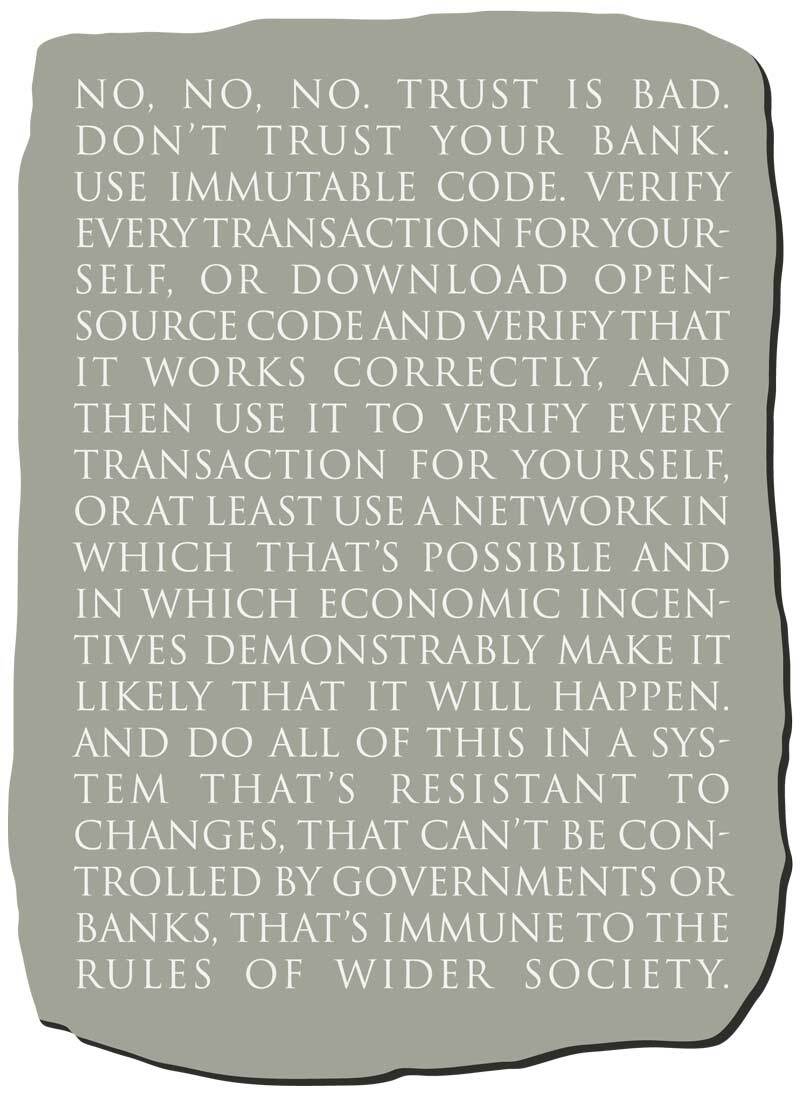

Also, though, you might have a philosophical objection to trust. Even if your bank has an absolutely unblemished record of keeping track of your money, that might not be good enough for you. Your bank is, to you, a black box. “How do I know you’ll give me my money back?” you could ask the bank. And the bank will say things like “Here are our audited financial statements” and “We are regulated by the Federal Reserve and insured by the Federal Deposit Insurance Corp.” and “We have never not given back anyone’s money.” And you’ll say, “Yes, yes, that’s all fine, but how do I know?” You don’t. Trust is built into the system, a prerequisite. You might want proof.3

Can you name this bank? Doesn’t matter, it’s still a black box!

ii. Composability

Even if you’re generally cool with trusting the keepers of modern databases, you might have a more technical objection. These databases aren’t always very good. Lots of the banking system is written in a very old computer language called Cobol; in the US people still frequently make payments—electronic transfers between electronic databases of money—by writing paper checks and putting them in the mail. US stock trades take two business days to settle: If I buy stock from you on a Monday, you deliver the stock (and I pay you) on Wednesday. This isn’t because your broker has to put stock certificates in a sack and bring them over to my broker’s office, while my broker puts dollar bills in a sack and brings them over to your broker’s office, but because the actual process is a descendant of that. It’s slow and manual and sometimes gets messed up; lots of stock trades “fail.”

Don’t even get me started on the property registry. If you buy a house, you have to go to a ceremony—a “closing”—where a bunch of people with jobs like “title company lawyer” mutter incantations that let you own the house. It can take hours.

If your model of how a database should work comes from modern computers, the hours of incantations seem insane. “There should be an API,” you might think: There should be an application programming interface allowing each of these databases to interact with the others. If your bank is thinking about giving you a mortgage, it should be able to query the property database automatically and find out that you own your house, rather than send a lawyer to the county clerk’s office. And it should be able to query the Department of Motor Vehicles registry automatically and get your driver’s license for identification purposes, and query your brokerage account automatically and examine your assets.

Modern life

consists of entries

in databases:

What if we

updated

them?

What if we rewrote all the databases from scratch, in modern computer languages using modern software engineering principles, with the goal of making them interact with one another seamlessly?

If you did that, it would be almost like having one database, the database of life: I could send you money in exchange for your house, or you could send me social reputation in exchange for my participation in an online class, or whatever, all in the same computer system.

That would be convenient and powerful, but it would also be scary. It would put even more pressure on trust. Whoever runs that one database would, in a sense, run the world. Whom could you trust to do that?

What if there was one database, and everyone ran it?

In 2008, Satoshi Nakamoto published a method for everyone to run a database, thus inventing “crypto.”

Well, I’m not sure that’s what Satoshi thought he was doing. Most immediately he was inventing Bitcoin: A Peer-to-Peer Electronic Cash System, which is the title of his famous white paper.

What Satoshi said he’d invented was a sort of cash for internet transactions, “an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.” If I want to buy something from you for digital cash—Bitcoin—I just send you the Bitcoin and you send me the thing; no “trusted third party” such as a bank is involved.

When I put it like that, it sounds as if Satoshi invented a system in which I can send you Bitcoin and nobody else is involved. What he actually invented was a system in which lots of other people are involved.

i. Digression: What are you even reading? Why are you reading it? Why am I writing it?

Hi! I’m Matt. I’m a former lawyer and investment banker. Now I’m a columnist at Bloomberg Opinion. In my day job, I write about finance. I like finance. It’s fun to write about. It’s a peculiar way of looking at the world, a series of puzzles, a set of structures that people have imposed on economic reality. Often those structures are arcane and off-putting, and it’s satisfying to understand what they’re up to. Everything in finance is accreted on top of a lot of other things in finance. Everything is weird and counterintuitive, and you often have to have a sense of financial history and market practice to understand why anyone is doing any of the things they’re doing.

For the past few years the most polarizing thing in finance has been crypto. Crypto is a set of ideas and products and technologies that grew out of the Bitcoin white paper. But it’s also, let’s be clear, a set of lines on charts that went up. When Satoshi invented Bitcoin, one Bitcoin was worth zero dollars: It was just an idea he made up. At its peak last November, one Bitcoin was worth more than $67,000, and the total value of all the crypto in circulation was something like $3 trillion. Many people who got into crypto early got very rich very fast and were very annoying about it. They bought Lamborghinis and islands. They were pleased with themselves: They thought crypto was the future, and they were building the future and being properly and amply rewarded for it. They said things like “Have fun staying poor” and “NGMI” (“not gonna make it”) to people who didn’t own crypto. They were right and rich and wanted you to know it.

Many other people weren’t into crypto. They got the not-entirely unjustified impression that it was mostly useful for crime or for Ponzi schemes. They asked questions like “What is this for?” or “Where did all this money come from?” or “If you’re building the future, what is the actual work you’re doing?” or “If you’re building the future, why does it seem so grim and awful?” And the crypto people, often, replied: “Have fun staying poor.”

And then, this year, those lines on charts went down. The price of one Bitcoin fell below $20,000; the total value of crypto fell from $3 trillion to $1 trillion; some big crypto companies failed. If you’re a crypto skeptic, this was very satisfying, not just as a matter of schadenfreude but also because maybe now everyone will shut up about crypto and you can go back to not paying attention to it. For crypto enthusiasts, this was just a reason to double down on grinding: The crash would shake out the casual fans and leave the true believers to build the future together.

In a sense it’s a dumb time to be talking about crypto, because the lines went down. But really it’s a good time to be talking about crypto. There’s a pause; there’s some repose. Whatever is left in crypto is not just speculation and get-rich-quick schemes. We can think about what crypto means—divorced, a little bit, from the lines going up.

I don’t have strong feelings either way about the value of crypto. I like finance. I think it’s interesting. And if you like finance—if you like understanding the structures that people build to organize economic reality—crypto is amazing. It’s a laboratory for financial intuitions. In the past 14 years, crypto has built a whole financial system from scratch. Crypto constantly reinvented or rediscovered things that finance had been doing for centuries. Sometimes it found new and better ways to do things.

Often it found worse ways, heading down dead ends that traditional finance tried decades ago, with hilarious results.

Often it hit on more or less the same solutions that traditional finance figured out, but with new names and new explanations. You can look at some crypto thing and figure out which traditional finance thing it replicates. If you do that, you can learn something about the crypto financial system—you can, for instance, make an informed guess about how the crypto thing might go wrong—but you can also learn something about the traditional financial system: The crypto replication gives you a new insight into the financial original.

Also, I have to say, as someone who writes about finance, I have a soft spot for stories of fraud and market manipulation and smart people putting one over on slightly less smart people. Often those stories are interesting and illuminating and, especially, funny. Crypto has a very high density of stories like that.

And so, now, I write a lot about crypto. Including quite a lot right here.

I need to give you some warnings. First, I don’t write about crypto as a deeply embedded crypto expert. I’m not a true believer. I didn’t own any crypto until I started working on this article; now I own roughly $100 worth. I write about crypto as a person who enjoys human ingenuity and human folly and who finds a lot of both in crypto.

Conversely, I didn’t sit down and write 40,000 words to tell you that crypto is dumb and worthless and will now vanish without a trace. That would be an odd use of time. My goal here is not to convince you that crypto is building the future and that if you don’t get on board you’ll stay poor. My goal is to convince you that crypto is interesting, that it has found some new things to say about some old problems, and that even when those things are wrong, they’re wrong in illuminating ways.

Also, I’m a finance person. It seems to me that, 14 years on, crypto has a pretty well-developed financial system, and I’m going to talk about it a fair bit, because it’s pretty well-developed and because I like finance.

BUT NO ONE SHOULD CARE THAT MUCH ABOUT A FINANCIAL SYSTEM.

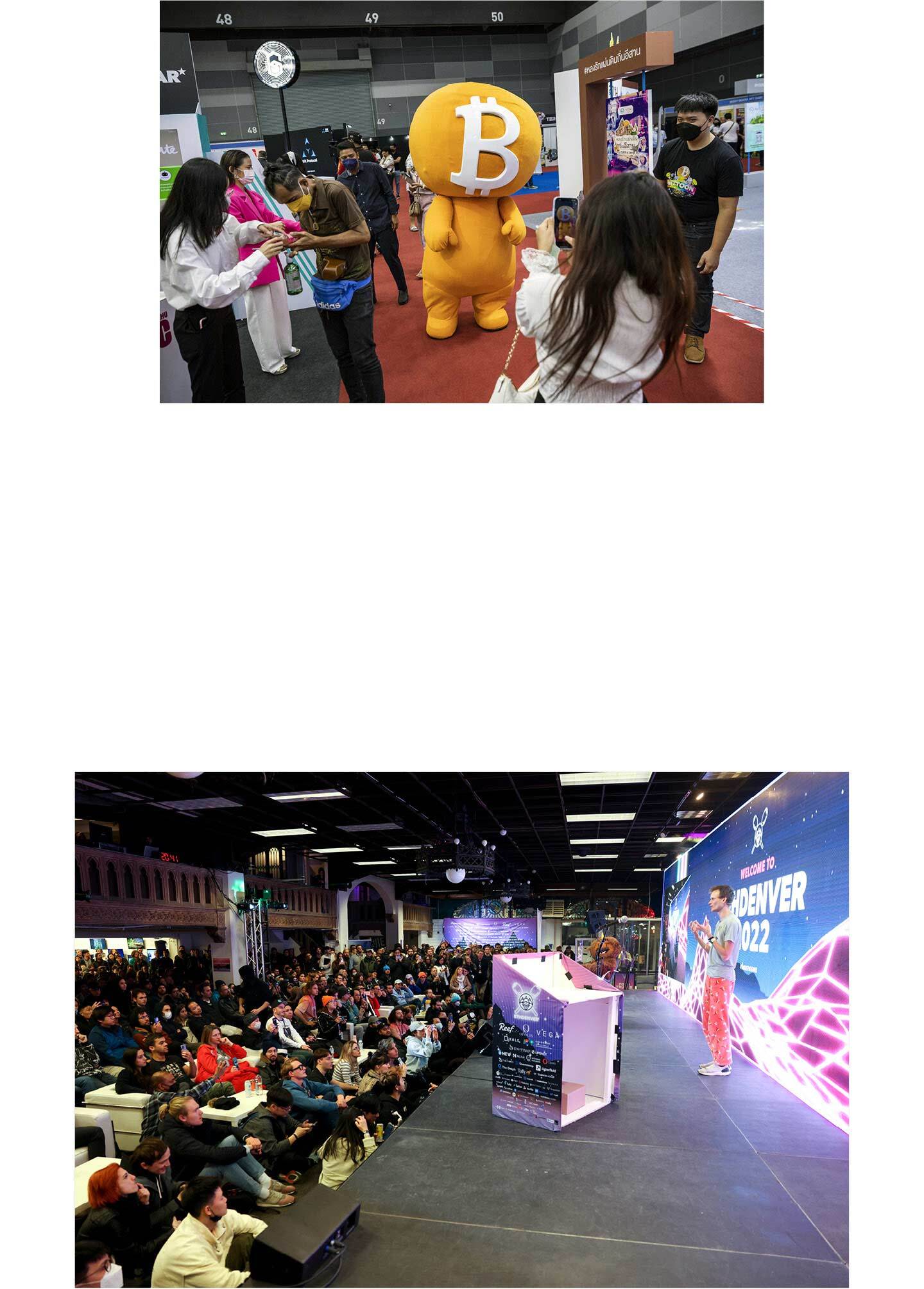

Riveted: A crowd at a Bitcoin conference in Miami, April 2022.

A financial system is, well, a series of databases. It’s a way to shuffle around claims on tangible stuff; it’s an adjunct to the real world. A financial system is good if it makes it easier for farmers to grow food and families to own houses and businesses to make awesome computer games, if it helps to create and distribute abundance in real life. A financial system is bad if it trades abstract claims in ways that enrich the people doing the trading but don’t help anyone else.

I … ehhh … uh. A salient question in crypto, for the past 14 years, has been: What is it good for? If you ask for an example of a business that actually uses crypto, the answers you’ll get are mostly financial businesses: “Well, we built a really great exchange for trading crypto.” Cool, OK. Sometimes these answers are plausibly about creating or distributing abundance: “Crypto lets emigrants send remittances cheaply and quickly.” That’s good. Often they’re about efficient gambling. Gambling is fun, nothing against it. But a financial system that was purely about gambling would be kind of limited.

Meanwhile, crypto’s most ardent boosters say crypto is about building real, useful things. Crypto will redefine social relationships, and gaming, and computers. It will build the metaverse. Crypto is the vital component of the next leap in the internet; crypto will build “web3” to replace our current “web2.” Maybe? If you ask for an example of a business that actually uses crypto, you’ll get a ton of real, lucrative financial businesses, then some vague theoretical musings like “Well, maybe we could build a social media network on web3?”

It’s still early. Maybe someone will build a really good social media network on web3. Maybe in 10 years, crypto and blockchains and tokens will be central to everything that’s done on the internet, and the internet will be (even more than it is now) central to everything that’s done in human life, and the crypto early adopters will all be right and rich while the rest of us will have fun staying poor, and schoolchildren will say, “I can’t believe anyone ever doubted the importance of Dogecoin.”

I don’t want to discount that possibility, and I do want to speculate about it a little bit, maybe sketch a picture of what that might mean. I’m not going to give you a road map for how we’ll get there. I’m not a tech person, and I’m not a true believer. But it is worth trying to understand what crypto could mean for the future of the internet, because the implications are sometimes utopian and sometimes dystopian and sometimes just a modestly more efficient base layer for stuff you do anyway. Plus the finance is cool, and it’s cool now.

ii. Digression: Names and people

Before we go on, let me say some things about some names. First, “crypto.” This thing I’m writing about here: There’s not a great name for it. The standard name, which I’ll use a lot, is crypto, which I guess is short for “cryptocurrency.” This is not a great name, because 1) it emphasizes currency, and a lot of crypto is not particularly about currency, and 2) it emphasizes cryptography, and while crypto is in some deep sense about cryptography, most people in crypto are not doing a ton of cryptography. You can be a crypto expert or a crypto billionaire or a leading figure in crypto without knowing much about cryptography, and people who are cryptography experts sometimes get a bit snippy about the crypto people stealing their prefix.

There are other names for various topics in crypto—

—and they’re sometimes used broadly to refer to a lot of what’s going on in crypto, but it’s not like they’re great either. So I’ll mostly stick with “crypto” as the general term.

Second, “Satoshi Nakamoto.” That’s a pseudonym, and whoever wrote his white paper has done a reasonably good job of keeping himself, herself, or themselves pseudonymous ever since. (There’s a lot of speculation about who the author might be. Some of the funnier suggestions include Elon Musk and a random computer engineer named, uh, Satoshi Nakamoto. I’m going to call Satoshi Nakamoto “Satoshi” and use he/him pronouns, because most people do.)

A related point. Other than (maybe?) Satoshi, basically everyone involved in cryptocurrency is a hilariously outsize personality. It’s a good bet that if you read an article about crypto, it will feature wild characters. (One story in Bloomberg Businessweek last year mentioned “sending billions of perfectly good US dollars to the Inspector Gadget co-creator’s Bahamian bank in exchange for digital tokens conjured by the Mighty Ducks guy and run by executives who are targets of a US criminal investigation.”) Except this one! There won’t be a single exciting person in this whole story. My goal here is to explain crypto, so that when you read about a duck guy doing crypto you can understand what it is that he’s doing.

iii. Digression: The “crypto” in crypto

Cryptography is the study of secret messages, of coding and decoding. Most of what I talk about in this article won’t be about cryptography; it will be about, you know, Ponzis. But the base layer of crypto really is about cryptography, so it will be helpful to know a bit about it.

The basic thing that happens in cryptography is that you have an input (a number, a word, a string of text), and you run some function on it, and it produces a different number or word or whatever as an output. The function might be the Caesar cipher (shift each letter of a word by one or more spots in the alphabet, so “Caesar” becomes “Dbftbs”), or pig Latin (shift the first consonants of the word to the end and add “-ay,” so “Caesar” becomes “Aesar-say”), or something more complicated.

A useful property in a cryptographic function is that it be “one-way.”4 This means it’s easy to turn the input string into the output string, but hard to do it in reverse; it’s easy to compute the function in one direction but impossible in the other. (The classic example is that multiplying two large prime numbers is quite straightforward; factoring an enormous number into two large primes is hard.) The Caesar cipher is easy to apply and easy to reverse, but some forms of encoding are easy to apply and much more difficult to reverse. That makes them better for secret codes.

One example of this is a “hashing” function, which takes some input text and turns it into a long number of a fixed size. So I could run a hashing function on this article—a popular one is called SHA-256, which was invented by the National Security Agency5—and generate a long, incomprehensible number from it. (To make it more incomprehensible, it’s customary to write this number in hexadecimal, so that it will have the digits zero through 9 but also “a” through “f.”) I could send you the number and say, “I wrote an article and ran it through a SHA-256 hashing algorithm, and this number was the result.” You’d have the number, but you wouldn’t be able to make heads or tails of it. In particular, you couldn’t plop it into a computer program and decode it, turning the hash back into this article.

The hashing function is one-way; the hash tells you nothing about the article, even if you know the hashing function. The hashing function basically shuffles the data in the article: It takes each letter of the article, represented as a binary number (a series of bits, 0s and 1s), and then shuffles around the 0s and 1s lots of times, mashing them together until they are all jumbled up and unrecognizable. The hashing function gives clear step-by-step instructions for how to shuffle the bits together, but they don’t work in reverse.6 It’s like stirring cream into coffee: easy to do, hard to undo.

Applying a SHA-256 algorithm will create a 64-digit number for data of any size you can imagine. Here’s a hash of the entire text of James Joyce’s 730-page novel Ulysses:

3f120ea0d42bb6af2c3b858a08be9f737dd422f5e92c04f82cb9c40f06865d0e

It fits in the same space as the hash of “Hi! I’m Matt”:

86d5e02e7e3d0a012df389f727373b1f0b1828e07eb757a2269fe73870bbd044

But what if I wrote “Hi, I’m Matt” with a comma? Then:

9f53386fc98a51b78135ff88d19f1ced2aa153846aa492851db84dc6946f558b

There’s no apparent relationship between the numbers for “Hi! I’m Matt” and “Hi, I’m Matt.” The two original inputs were almost exactly identical; the hash outputs are wildly different. This is a critical part of the hashing function being one-way: If similar inputs mapped to similar outputs, then it would be too easy to reverse the function and decipher messages. But for practical purposes, each input maps to a random output.7

What’s the point of a secret code that can’t be decoded? For one thing, it’s a way to verify. If I sent you a hash of this article, it wouldn’t give you the information you need to re-create the article.8 But if I then sent you the article, you could plop that into a computer program (the SHA-256 algorithm) and generate a hash. And the hash you generate will exactly match the number I sent you. And you’ll say, “Aha, yes, you hashed that article all right.” It’s impossible for you to decode the hash, but it’s easy for you to check that I had encoded it correctly.

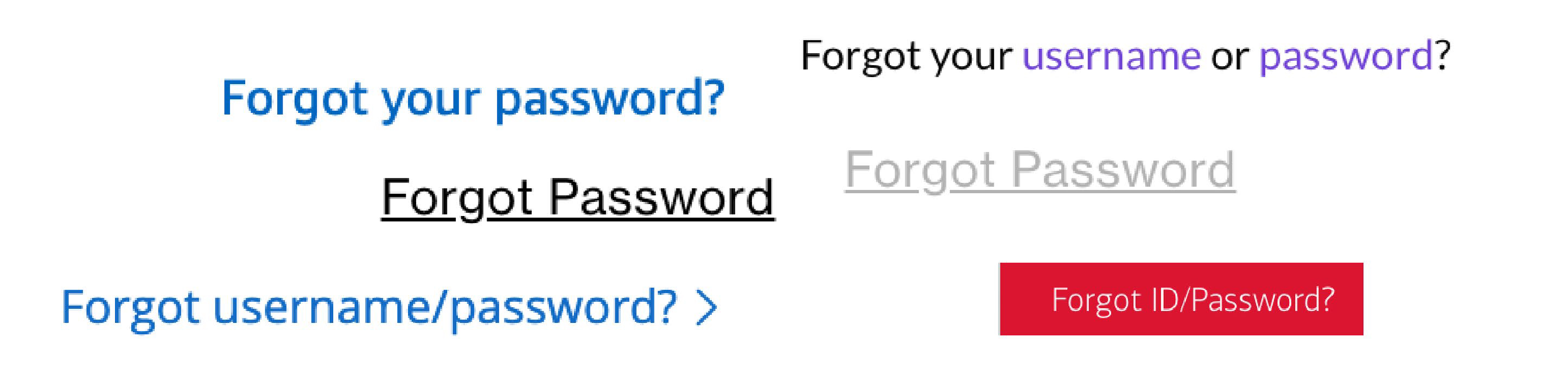

This would be dumb to do with this article, but the principle has uses. A simple, everyday one is passwords. If I have a computer system and you have a password to log in to the system, I need to be able to check that your password is correct. One way to do this is for my system to store your password and check what you type against what I’ve stored: I have a little text file with all the passwords, and it has “Password123” written next to your username, and you type “Password123” on the login screen, and my system checks what you type against the file and sees that they match and lets you log in. But this is a dangerous system: If someone steals the file, they would have everyone’s password. It’s better practice for me to hash the passwords. You type “Password123” as your password when setting up the account, and I run it through a hash function and get back

008c70392e3abfbd0fa47bbc2ed96aa99bd49e159727fcba0f2e6abeb3a9d601

and I store that on my list. When you try to log in, you type your password, and I hash it again, and if it matches the hash on my list, I let you in. If someone steals the list, they can’t decode your password from the hash, so they can’t log in to the system.9

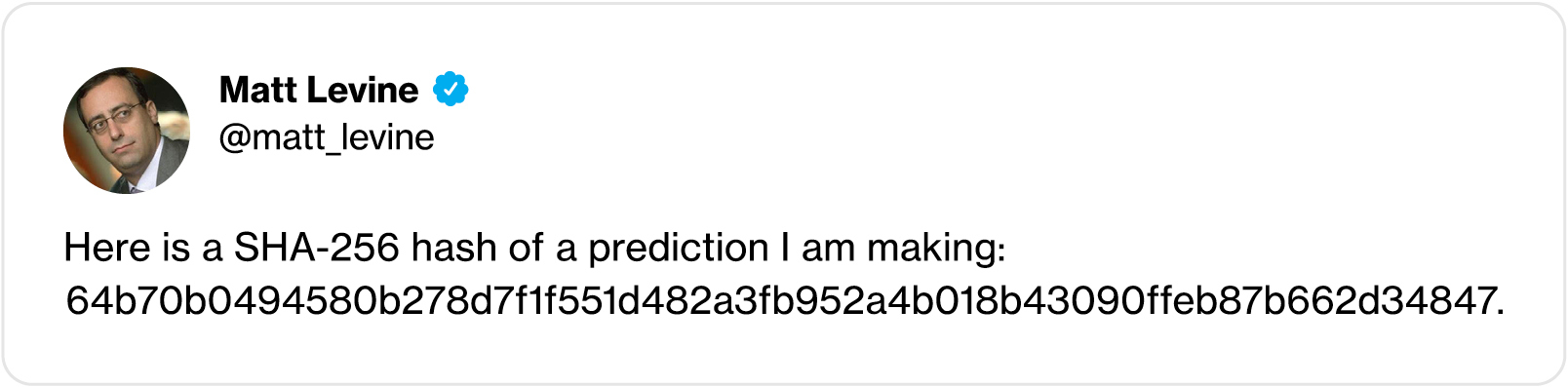

There are other, more crypto-nerdy uses for hashing. One is a sort of time stamping. Let’s say you predict some future event, and you want to get credit when it does happen. But you don’t want to just go on Twitter now and say, “I predict that the Jets will win the Super Bowl in 2024,” to avoid being embarrassed or influencing the outcome or whatever. One thing you could do is write “the Jets will win the Super Bowl in 2024” on a piece of paper, put it in an envelope, seal the envelope, and ask me to keep it until the 2024 Super Bowl, after which you’ll tell me either to open the envelope or burn it. But this requires you and everyone else to trust me.

Another, trustless thing you could do is type “the Jets will win the Super Bowl in 2024” into a cryptographic hash generator, and it will spit out:

64b70b0494580b278d7f1f551d482a3fb952a4b018b43090ffeb87b662d34847

and then you can tweet,

Not a real tweet! But you can follow me on Twitter at @matt_levine.

Everyone will say, “Well, aren’t you annoying,” but they won’t be able to decode your prediction. And then in a while, when the Jets win the Super Bowl, you can say, “See, I called it!” You retweet the hashed tweet and the plain text of your prediction. If anyone is so inclined, they can go to a hash calculator and check that the hash really matches your prediction. Then all the glory will accrue to you.

Aside from hashing, another important one-way function is public-key encryption. I have two numbers, called a “public key” and a “private key.” These numbers are long and random-looking, but they’re related to each other: Using a publicly available algorithm, one number can be used to lock a message, and the other can unlock it. The two-key system solves a classic problem with codes: If the key I use to encrypt a message is the same one you’ll need to decode it, at some point I’ll have to have sent you that key. Anyone who steals the key in transit can read our messages.

With public-key encryption, no one needs to share the secret key. The public key is public: I can send it to everyone, post it on my Twitter feed, whatever. The private key is private, and I don’t give it to anyone. You want to send me a secret message. You write the message and run it through the encryption algorithm, which uses 1) the message and 2) my public key (which you have) to generate an encrypted message that you send to me. Then I run the message through a decryption program that uses 1) the encrypted message and 2) my private key (which only I have) to generate the original message, which I can read. You can encrypt the message using my public key, but nobody can decrypt it using the public key. Only I can decrypt it using my private key. (The function is one-way as far as you’re concerned, but I can reverse it with my private key.)

A related idea is a “digital signature.” Again, I have a public key and a private key. My public key is posted in my Twitter bio. I want to send you a message, and I want you to know that I wrote it. I run the message through an encryption program that uses 1) the message and 2) my private key. Then I send you 1) the original message and 2) the encrypted message.

You use a decryption program that uses 1) the encrypted message and 2) my public key to decrypt the message. The decrypted message matches the original message. This proves to you that I encrypted the message. So you know that I wrote it. I could’ve just sent you a Twitter DM instead, but this is more cryptographic.

Imagine a simple banking system in which bank accounts are public: There’s a public list of accounts, and each one has a (public) balance and public key. I say to you: “I control account No. 00123456789, which has $250 in it, and I’m going to send you $50.” I send you a digitally signed message saying “here’s $50,” and you decode that message using the public key for the account, and then you know that I do in fact control that account and everything checks out. That’s the basic idea at the heart of Bitcoin, though there are also more complicated ideas.

iv. How Bitcoin works

The simple form of Bitcoin goes like this. There’s a big public list of addresses, each with a unique label that looks like random numbers and letters, and some balance of Bitcoin in it. An address might have the label “1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa”10 and a balance of 68.6 Bitcoin. The address acts as a public key.11 If I “own” those Bitcoin, what that means is I possess the private key corresponding to that address, effectively the password accessing the account.

Because I have the private key, I can send you a Bitcoin by signing a message to you with my private key. You can check that signature against my public key and against the public list of addresses and Bitcoin balances. That information is enough for you to confirm that I control the Bitcoin that I’m sending you, but not enough for you to figure out my private key and steal the rest of my Bitcoin.

That kind of means I can send you a Bitcoin without you trusting me, or me trusting you, or either of us trusting a bank to verify that I have the money. “We define an electronic coin as a chain of digital signatures,” Satoshi wrote. The combination of public address and private key is enough to define a coin. Cryptocurrency is called cryptocurrency because it’s a currency derived from cryptography.

Satoshi said a Bitcoin is essentially a chain of signatures.

You’ll notice that all we’ve done here is exchange a message, and somehow called the result of that a currency. The traditional financial system isn’t so different: Banks don’t move around sacks of gold or even very many paper bills. They’re keepers of databases. What happens, roughly, when I make a $100 payment to you is my bank sends a message to your bank telling it to update its ledger.

Similarly, in Bitcoin the messages change a (public) ledger of who holds what. But who maintains that? The rough answer is that the Bitcoin network—thousands of people who use Bitcoin and run its software on their computers—keeps the ledger, collaboratively and redundantly. There are thousands of copies of the ledger; every node on the network has its own list of how many Bitcoin are in each address.

Then, when we do a transaction—when I send you a Bitcoin—we don’t just do it privately; we broadcast it to the entire network so everyone can update their lists. If I send you a Bitcoin from my address, and my signature on the transaction is valid, everyone will update their ledgers to add one Bitcoin to your address and subtract one from mine.

The ledger is not really just a list of addresses and their balances; it’s actually a record of every single transaction.12 The ledger is maintained by everyone on the network keeping track of every transaction for themselves.13

That’s nice! But now, instead of trusting a bank to keep the ledger of your money, you’re trusting thousands of anonymous strangers.

What have we accomplished?

Well it’s not quite as bad as that. Each transaction is provably correct: If I send a Bitcoin from my address to yours and sign it with my private key, the network will include the transaction; if I try to send a Bitcoin from someone else’s address to yours and don’t have the private key, everyone on the network can see that it’s fake and won’t include the transaction. Everyone runs open-source software to update the ledger for transactions that are verifiable. Everyone keeps the ledger, but you can prove that every transaction in the ledger is valid, so you don’t have to trust them too much.

Incidentally, I am saying that “everyone” keeps the ledger, and that was probably roughly true early in Bitcoin’s life, but no longer. There are thousands of people running “full nodes,” which download and maintain and verify the entire Bitcoin ledger themselves, using open-source official Bitcoin software. But there are millions more not doing that, just having some Bitcoin and trusting that everybody else will maintain the system correctly. Their basis for this trust, though, is slightly different from the basis for your trust in your bank. They could, in principle, verify that everyone verifying the transactions is verifying them correctly.

Notice, too, that there’s a financial incentive for everyone to be honest: If everyone is honest, then this is a working payment system that might be valuable. If lots of people are dishonest and put fake transactions in their ledgers, then no one will trust Bitcoin and it will be worthless. What’s the point of stealing Bitcoin if the value of Bitcoin is zero?

This is a standard approach in crypto: Crypto systems try to use economic incentives to make people act honestly, rather than trusting them to act honestly.

That’s most of the story, but it leaves some small problems. Where did all the Bitcoin come from? It’s fine to say that everyone on the network keeps a ledger of every Bitcoin transaction that ever happened, and your Bitcoin can be traced back through a series of previous transactions. But traced back to what? How do you start the ledger?

Another problem is that the order of transactions matters: If I have one Bitcoin in my account and I send it to you, and then I send it to someone else, who actually has the Bitcoin? This seems almost trivial, but it’s tricky. Bitcoin is a decentralized network that works by broadcasting transactions to thousands of nodes, and there’s no guarantee they’ll all arrive in the same order everywhere. And if everyone doesn’t agree on the order, bad things—“double spending,” or people sending the same Bitcoin to two different places—can happen. “Transactions must be publicly announced,” wrote Satoshi, “and we need a system for participants to agree on a single history of the order in which they were received.”

That system, I’m sorry to say, is the blockchain.

v. Oh, the blockchain

Every Bitcoin transaction is broadcast to the network. Some computers on the network—they’re called “miners”—compile the transactions as they arrive into a group called a “block.” At some point, a version of a block becomes, as it were, official: The list of transactions in that block, in the order in which they’re listed, becomes canonical, part of the official Bitcoin record. We say that the block has been “mined.”14 In Bitcoin, a new block is mined roughly every 10 minutes.15

The miners then start compiling a new block, which will also eventually be mined and become official. Here’s where hashing becomes important. That new block will refer to the block before it by containing a hash of that block—this confirms that the block before it 1) is correct and accepted by the network and 2) came before it in time. Each block will refer to the previous block in a chain—oh, yes, a blockchain. The blockchain creates an official record of what transactions the network has agreed on and in what order. The hashes are time stamps; they create an agreed order of transactions.

You could imagine a simple system for doing this. Every 10 minutes a miner proposes a list of transactions, and all the computers on the Bitcoin network vote on it. If it gets a majority, it becomes official and is entered into the blockchain.

Unfortunately this is a bit too simple. There are no rules about who can join the Bitcoin network: Anyone who hooks up a computer and runs the open-source Bitcoin software can do it. You don’t have to prove you’re a good person, or even a person. You can hook up a thousand computers if you want.

What mining looks like, in Nadvoitsy, Russia.

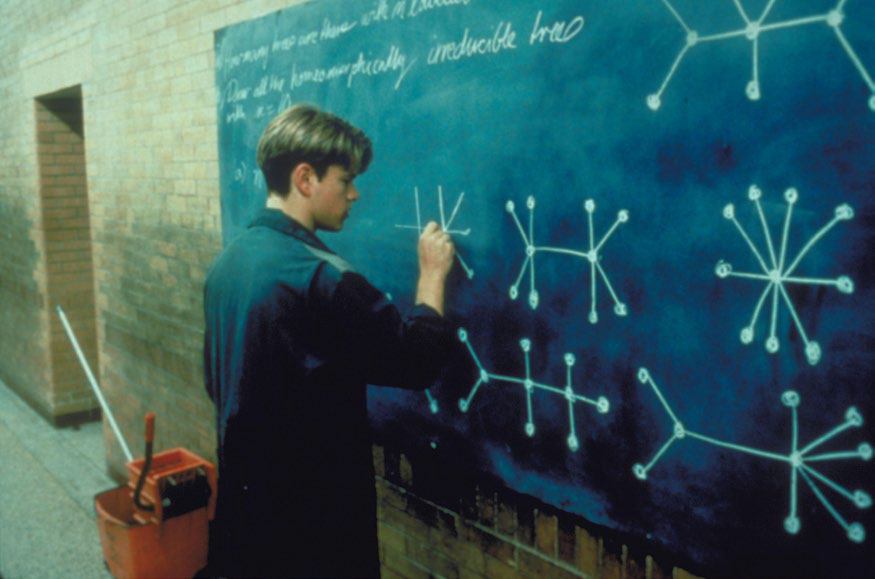

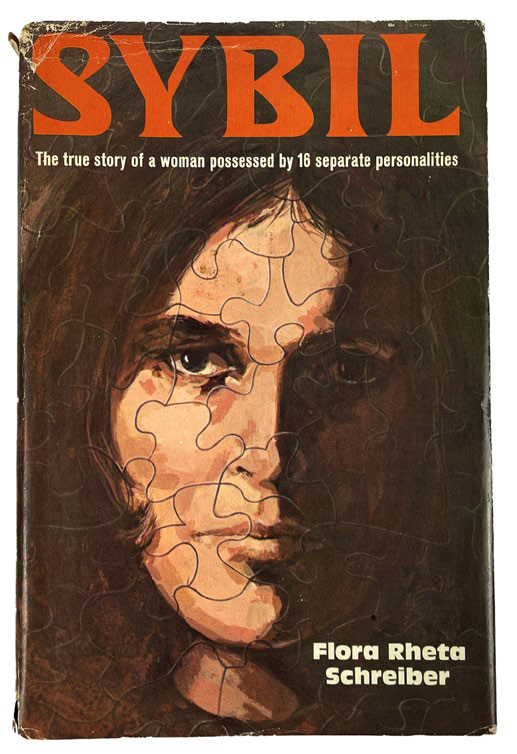

This creates a risk of what’s sometimes called a “Sybil attack,” named not after the ancient Greek prophetesses but, rather, after the 1973 book about a woman who claimed to have multiple personalities. The idea of a Sybil attack is that, in a system where the ledger is collectively maintained by the group and anyone can join the group without permission, you can spin up a bunch of computer nodes so that you look like thousands of people. Then you verify bad transactions to yourself, and everyone is like, “Ah, well, look at all of these people verifying the transactions,” and they accept your transactions as the majority consensus, and either you manage to steal some money or you at least throw the whole system into chaos.

Sybil (1973).

The solution to this is to make it expensive to verify transactions.

To mine a block, Bitcoin miners do an absurd and costly thing. Again, it involves hashing. Each miner takes a summary of the list of transactions in the block, along with a hash of the previous block. Then the miner sticks another arbitrary number—called a “nonce”—on the end of the list. The miner runs the whole thing (list plus nonce) through a SHA-256 hashing algorithm. This generates a 64-digit hexadecimal number. If that number is small enough, then the miner has mined the block. If not, the miner tries again with a different nonce.

What “small enough” means is set by the Bitcoin software and can be adjusted to make it easier or harder to mine a block. (The goal is an average of one block every 10 minutes; the more miners there are and the faster their computers are, the harder it gets.) Right now, “small enough” means that the hash has to start with 19 zeros. A recent successful one looked like this:

It’s like a game of 20 questions where you’re constantly guessing a number that will work. Except you get no clues, and it’s many, many, many times more than 20 guesses. It is vanishingly, vanishingly unlikely that any particular input—any list of transactions plus a nonce—will hash to a number that starts with 19 zeros. The odds are roughly 75 sextillion-to-1 against. So the miners run the hash algorithm over and over again, trillions of times, guessing a different nonce each time, until they get a hash with the right number of zeros.16 The total hash rate of the Bitcoin network is something north of 200 million terahashes per second—that is, 200 quintillion hash calculations per second, which is 1) a lot but 2) a lot fewer than 75 sextillion. It takes many seconds—600 on average—at 200 quintillion hashes per second to guess the right nonce and mine a block.

This is a race. Only one miner gets to mine a block, and that miner gets rewarded with Bitcoin. To mine a block is also to “mine” new coins—to pry them out of the system after much computational work, like finding a seam of gold after picking through rock. Hence the metaphor.

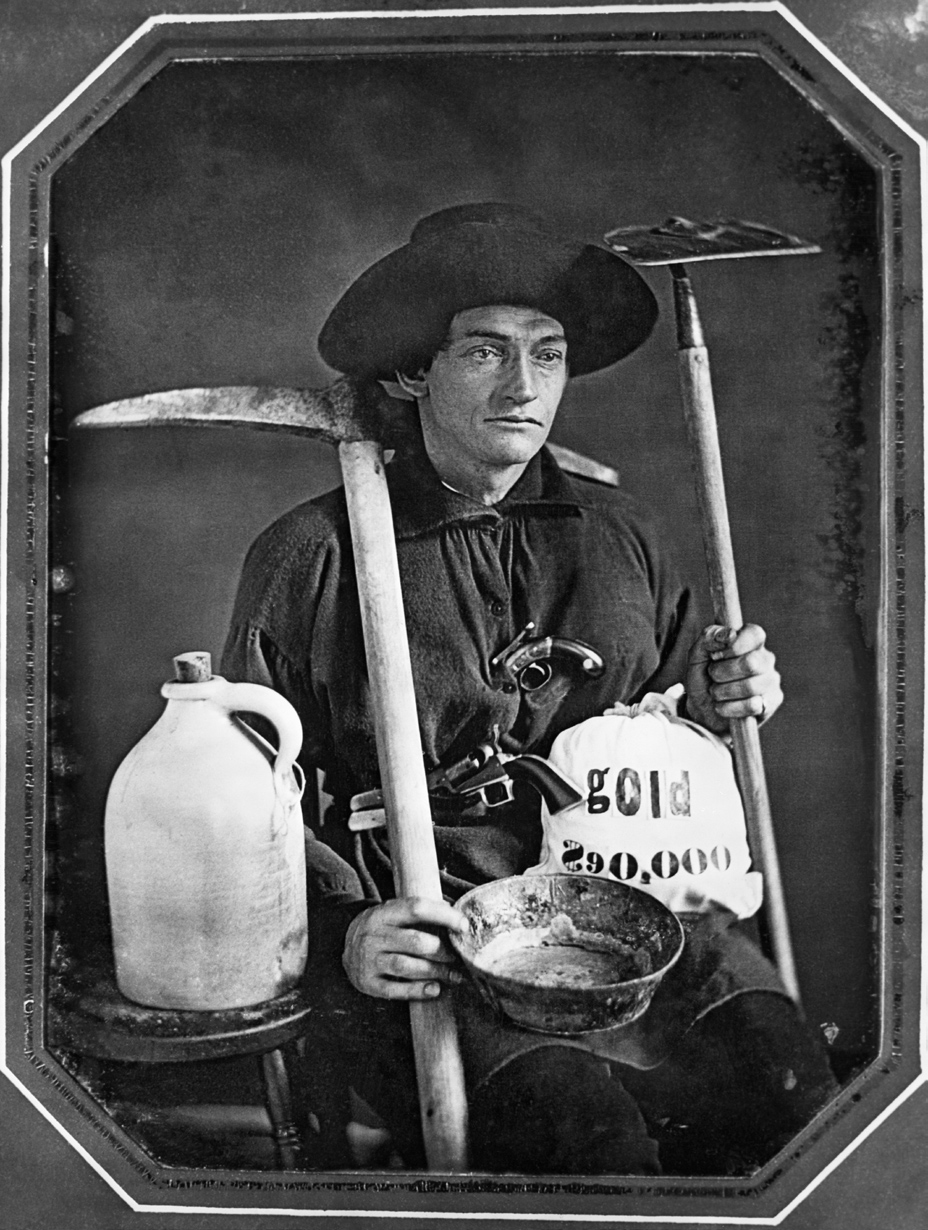

An old-fashioned prospector, circa 1860.

When miners find the right number of zeros, they publish the block and its hash to the Bitcoin network. Everyone else reviews the block and decides if it’s valid. (“Valid” means all the transactions on the list are valid, the hash is correct, it has the right number of zeros, etc.) If they do, then they start work on the next block: They take the hash of the previous block, plus the transactions that have come in since then, plus a new nonce, and try to find a new hash. Each block builds on the one before.

vi. Mining

All of this is incredibly costly: Miners need special hardware to do all of these hashing calculations over and over again, and these days run huge farms of always-on computers. Mining Bitcoin uses as much electricity as various medium-size countries. This is not great for the environment. The most famous description of Bitcoin, attributed to a Twitter poster, might be:

And it is in some sense purely wasteful. People sometimes say Bitcoin miners are, like, solving difficult math problems to do their mining, but they aren’t, really. They’re brute-force guessing quintillions of numbers per second to try to get the right hash. No math problems are being solved, and nothing is added to the world’s knowledge, by those quintillions of guesses.

But the miners are solving an important problem for Bitcoin, which is the problem of keeping its network and its ledger of transactions secure. It’s demonstrably costly to confirm Bitcoin transactions, so it’s hard to fake, hard to run a Sybil attack. That’s why Satoshi, and everyone else, calls this method of confirming transactions “proof of work.” If you produce the right hash for a block, it proves you did a lot of costly computer work. You wouldn’t do that lightly.

Proof-of-work mining is a mechanism for creating consensus among people with an economic stake in a system, without knowing anything else about them. You’d never mine Bitcoin if you didn’t want Bitcoin to be valuable. If you’re a Bitcoin miner, you’re invested in Bitcoin in some way; you’ve bought computers and paid for electricity and made an expensive, exhausting bet on Bitcoin. You have proven that you care, so you get a say in verifying the Bitcoin ledger. And you get paid. You get paid Bitcoin, which gives you even more of a stake in the system.

These Bitcoin come out of nowhere; they’re generated by this mining, by the core Bitcoin software. In fact, all Bitcoin are generated by mining; there was never an initial allocation of Bitcoin to Satoshi Nakamoto or to early investors or anyone else. This is the answer to the question of where Bitcoin come from: They were all mined.

Originally the mining reward, which is set by the software, was 50 Bitcoin per block; currently it’s 6.25 Bitcoin. One important point about these mining rewards is that they cost Bitcoin users money. Every block—roughly every 10 minutes—6.25 new Bitcoin are produced out of nowhere and paid to miners for providing security to the network. That works out to more than $6 billion per year.17 This cost is indirect: It is a form of inflation, and as the supply of Bitcoin grows,18 each coin in theory becomes worth a little less, all else being equal. Right now, the Bitcoin network is paying around 1.5% of its value per year to miners.

That’s lower than the inflation rate of the US dollar. Still, it’s worth noting. Every year, the miners who keep the Bitcoin system secure capture a small but meaningful chunk of the total value of Bitcoin. Bitcoin users get something for that $6 billion:19

If you can make a lot of money mining Bitcoin, a lot of people will want to mine Bitcoin. This will make it harder for one person to accumulate most of the mining power in Bitcoin. If one person or group got a majority of the mining power, they could do bad things: They could mine a bad block—double-spending coins, reversing recent transactions, etc. (This is called a “51% attack.”) When there are billions of dollars up for grabs for miners, people will invest a lot of money in mining, and it will be expensive to compete with them. And if you invested billions of dollars to accumulate a majority of the mining power in Bitcoin, you would probably care a lot about maintaining the value of Bitcoin, and so you’d be unlikely to use your powers for evil.

II

What Does It Mean?

So, huh, that’s neat. OK, then. I’ve described in some detail the workings of the thing, Bitcoin, that Satoshi Nakamoto invented. But let’s take a step back: What exactly is it that he invented?

The simplest answer is that he invented Bitcoin.

BITCOIN IS A BIG THING.

At its peak, the total value of Bitcoin in the world was more than $1 trillion. There are thousands of articles about it; it has lots of investors and fans and believers. Some of these people are called “Bitcoin maximalists”; they believe that the only really interesting and valuable thing in the world of crypto is Bitcoin. Those people could stop here, I guess. There it is, Bitcoin.

Here, though, I want to keep going. I want to talk about different ways that you might generalize Satoshi’s invention. There are different ways to interpret what Satoshi was up to and what he accomplished, and each interpretation points you to a different direction for crypto.

A minimal generalization of Bitcoin is something like: Satoshi invented a technology for people to send numbers to one another. That’s not nothing. Before Satoshi, I could’ve written you an email that said “132.51,” but you’d have no way of knowing whether I had the 132.51 on my computer or whether I’d already sent the 132.51 to someone else, and you’d have no way of proving to other people that you now had the 132.51 on your computer and could send it to them.

I realize that paragraph sounds very stupid, because it is. You definitely have 132.51 on your computer, as well as every other conceivable number; computers can generate numbers arbitrarily and more or less for free. Open a spreadsheet, type “132.51,” and there you go. In a sense, the technological accomplishment of Bitcoin is that it invented a decentralized way to create scarcity on computers. Bitcoin demonstrated a way for me to send you a computer message so that you’d have it and I wouldn’t, to move items of computer information between us in a way that limited their supply and transferred possession.

But the technological accomplishment is not the whole story, arguably not even the most important part. The wild thing about Bitcoin is not that Satoshi invented a particular way for people to send numbers to one another and call them payments. It’s that people accepted the numbers as payments.

There’s nothing inherent in the technology that would make that happen. People might have read the Bitcoin white paper and said, “Huh, this is a cool way to send payments, but your problem is that you aren’t sending dollars, you’re sending this thing you just made up, and who wants that?” Well, most of them did say that, initially. But lots of people eventually decided that Bitcoin was valuable.

That’s weird! Satoshi was like,

And enough people were like,

Illustration: C.W. Moss

that now crypto is a trillion-dollar business. That social fact, that Bitcoin was accepted by many millions of people as having a lot of value, might be the most impressive thing about Bitcoin, much more than the stuff about hashing.

i. Shitcoins

Here’s another extremely simple generalization of Bitcoin:

- You can make up an arbitrary token that trades electronically.

- If you do that, people might pay a nonzero amount of money for it.

- Worth a shot, no?

As Bitcoin became more visible and valuable, people just … did … that? There was a rash of cryptocurrencies that were sometimes subtle variations on Bitcoin and sometimes just lazy knockoffs. “Shitcoins” is the mean name for them.

See what we did there?

In 2013 two software engineers threw together a cryptocurrency and gave it a logo of Doge, the talking shiba inu meme. They called it Dogecoin, and it was a parody of the coin boom. It’s worth about $8 billion today. I’m not going to explain that to you. Nobody is going to explain that to you. Certainly the guys who invented Dogecoin don’t understand it; one of them has taken to Twitter to say he hates it. It’s just, like, if you’re making up an arbitrary token that trades electronically, and you hope people will buy it for no particular reason, you might as well make it fun. Slap a talking dog on it; give people stuff to make jokes about online.

Incidentally, here’s a fun argument that was made against Bitcoin early in its life:

- There’s a limited supply of Bitcoin.

- But the Bitcoin software is open-source and can be cloned trivially.

- So if the price of Bitcoin gets above, you know, $100, someone will just invent Blitcoin, which will be an exact copy of Bitcoin.

- Bitcoin is arbitrary, and Blitcoin is arbitrary, so there’s no reason that Blitcoin should trade at much of a discount to Bitcoin.

- This will dilute the value of Bitcoin: any sensible person would rather pay $90 for Blitcoin than $105 for Bitcoin, since they’re the same thing but one is cheaper.

- Therefore, there’s an infinite supply of Bitcoin or things that are exactly like it, so the value of Bitcoin cannot get too high.

This argument turned out to be mostly wrong. Socially, cryptocurrency is a coordination game; people want to have the coin that other people want to have, and some sort of abstract technical equivalence doesn’t make one cryptocurrency a good substitute for another. Social acceptance—legitimacy—is what makes a cryptocurrency valuable, and you can’t just copy the code for that.

That’s a revealing fact: What makes Bitcoin valuable isn’t the elegance of its code, but its social acceptance.20 A thing that worked exactly like Bitcoin but didn’t have Bitcoin’s lineage—didn’t descend from Satoshi’s genesis block and was just made up by some copycat—would have the same technology but none of the value.

ii. An uncorrelated asset

Here’s another generalization of Bitcoin:

-

Satoshi made up an arbitrary token that trades electronically for some price.

-

The price turns out to be high and volatile.

-

The price of an arbitrary token is … arbitrary?

This may not sound that great to you. But it’s very interesting as a matter of finance theory. Modern portfolio theory demonstrates that adding an uncorrelated asset to a portfolio can improve returns and reduce risk. Big institutions will invest in timberland or highway tolls or hurricane insurance, because they think that those things won’t act just like stocks or bonds, that they’ll diversify their portfolios, that they’ll hold up even in a world where stocks go down.

To the extent that the price of Bitcoin 1) mostly goes up, though with lots of ups and downs along the way, and 2) goes up and down for reasons that are arbitrary and mysterious and not tied to, like, corporate earnings or the global economy, then Bitcoin is interesting to institutional investors.

There are variations. For instance:

-

Bitcoin is not just uncorrelated to regular financial stuff—it’s a hedge to inflation. If the Federal Reserve is printing money recklessly, the dollar will lose value, but Bitcoin is in limited supply and will maintain its value even as the dollar is inflated away.

-

Bitcoin is like gold but more convenient. The value of gold is also somewhat arbitrary and mysterious, but it’s a store of value that’s not tied to corporate earnings and central bank policy. Investors who like gold should buy Bitcoin.

Well, those are some things that people said. In practice, it turns out that the price of Bitcoin is pretty correlated with the stock market, especially tech stocks. Bitcoin hasn’t been a particularly effective inflation hedge: Its price rose during years when US inflation was low, and it’s fallen this year as inflation has increased. The right model of crypto prices might be that they go up during broad speculative bubbles when stock prices go up, and then they go down when those bubbles pop. That’s not a particularly appealing story for investors looking to diversify. You want stuff that goes up when the broad bubbles pop!

iii. GameStop

The simple story of GameStop is that some people on the internet liked the stock.

I’m not going to dwell on the meme-stock phenomenon here—I dwelt on it in this publication last December. But one important possibility is that the first generalization of Bitcoin, that an arbitrary tradeable electronic token can become valuable just because people want it to, permanently broke everyone’s brains about all of finance.

Before the rise of Bitcoin, the conventional thing to say about a share of stock was that its price represented the market’s expectation of the present value of the future cash flows of the business. But Bitcoin has no cash flows; its price represents what people are willing to pay for it. Still, it has a high and fluctuating market price; people have gotten rich buying Bitcoin. So people copied that model, and the creation of and speculation on pure, abstract, scarce electronic tokens became a big business.

A share of stock is a scarce electronic token. It’s also something else! A claim on cash flows or whatever. But one thing that it is is an electronic token that’s in more or less limited supply. If you and your friends online want to make jokes and invest based on those jokes, then, depending on your sense of humor and which online chat group you’re in, you might buy either Dogecoin or GameStop Corp. stock, and for your purposes those things are not that different.

B.

A Distributed Computer

Here’s another, very different generalization of Bitcoin. In its sharpest form, it’s mostly attributed to programmer Vitalik Buterin, another colorful character whom we won’t discuss.21 It goes like this:

-

Look, this thing you made is a big, sprawling computer. The blockchain is doing the functions of a computer. Specifically, it’s keeping a database of Bitcoin transactions.

-

This computer has some fascinating properties. It’s distributed: The computer’s data aren’t kept on any one particular machine but spread out among lots of nodes. The blockchain creates a mechanism to make sure they all agree on what the database says. It’s decentralized: Different people run the database on their own separate machines. It’s secure and final: Because of how transactions are encoded into blocks, it’s more or less impossible for someone to reach back into the database and change a transaction from last week. And it’s trustless and permissionless: Anyone who wants to can download the blockchain or mine Bitcoin. The mining mechanism gives people incentives to collaborate and compete with one another to keep the database secure and up to date.

-

But it’s not a very good computer. Mostly it just keeps a list of payments.

4. LET’S DO THE SAME THING, BUT MAKE IT A GOOD COMPUTER.

Vitalik at ETHDenver in February. Told you he was colorful!

i. Ethereum

The computer that Vitalik22 invented is generally called Ethereum, or the Ethereum Virtual Machine: It’s a virtual computer, distributed among thousands of redundant nodes. Each node knows the “state” of the computer—what’s in its memory—and each transaction on the system updates that state.

Ethereum works a lot like Bitcoin: People create transactions, they broadcast them to the network, the transactions are included in a block, the blocks get chained together, everyone can see every transaction, etc. The currency of the Ethereum blockchain is called … I dunno, it’s common to call it “Ether,” though sometimes people say “Ethereum,” and often they just write “ETH.” (Similarly, Bitcoin is sometimes written “BTC.”) In conversation it’s mostly shortened to “Eth,” pronounced “Eeth.”

But whereas Bitcoin transactions are mostly about sending payments,23 actions on Ethereum are conceived of more generally: Ethereum is a big virtual computer, and you send it instructions to do stuff on the computer. Some of those instructions are “Send 10 Ether from Address X to Address Y”: One thing in the computer’s memory is a database of Ethereum addresses and how much Ether is in each of them, and you can tell the computer to update the database.

But you can also write programs to run on the computer to do things automatically. One sort of program might be: Send 10 Ether to Address Y if something happens. Alice and Bob might want to bet on a football game, or on a presidential election, or on the price of Ether.24 They might write a computer program on the Ethereum Virtual Machine to do that. The program would have its own Ethereum account where it could keep Ether, and its programming logic would say something like “if the Jets win on Sunday”—or “if Joe Biden wins the election,” or “if Ether trades above $1,500 on November 1”—“then send the money in this account to Alice; otherwise send it to Bob.” Alice and Bob might then each send one Ether to the account, and it would whir along for a bit checking the football scores or the election results or the Ether price,25 and then when it had an answer to its question—who won the game or the election or is Ether above $1,500—it would automatically resolve the bet and send two Ether to the winner.

Or you could have a program that says: “If anyone sends one Ether to this program, the program will send them back something nice.” “Something nice” is pretty hazy there, and frankly it’s pretty hazy in actual practice, but in concept anything that you can put into a computer program could be the reward here. So “send me one Ether and I will send you back a digital picture of a monkey” would be one possible program, and I guess it sounds like I’m joking, but for a while digital pictures of monkeys were selling for millions of dollars on Ethereum. Or there’s a thing called the Ethereum Name Service, or ENS, which allows people to register domain names like “matthewlevine.eth” and use them across various Ethereum functions. You send Ether to the ENS program, and it registers that name to you—you send in money, and it sends you back a domain.

Funny, that doesn’t look like a contract.

The standard analogy here is a vending machine: A vending machine is a computer in the real world, where you put in a dollar and you get back something that you want. You don’t negotiate with the vending machine, or make small talk about the weather while it rings you up. The vending machine’s side of the transaction is entirely automated. Its programming makes it respond deterministically to you putting in money and pressing buttons.

In the crypto world, these programs are called “smart contracts.” The name is a bit unfortunate. A smart contract is a computer program that runs on the blockchain. Some smart contracts look like contracts: Alice and Bob’s bet on the price of Ethereum looks a lot like a financial derivative, which is definitely a contract. Some smart contracts look like vending machines: They sit around in public waiting for people to put money in, and then they spit out goods. A vending machine is not exactly a normal contract, but it is a transaction, and people who are into philosophizing about contracts like thinking about vending machines.

But some smart contracts just look like, you know, computer programs. The concept is more general than the name. In the Ethereum white paper, Vitalik Buterin wrote:

Note that “contracts” in Ethereum should not be seen as something that should be “fulfilled” or “complied with”; rather, they are more like “autonomous agents” that live inside of the Ethereum execution environment, always executing a specific piece of code when “poked” by a message or transaction, and having direct control over their own ether balance and their own key/value store to keep track of persistent variables.

There are limits: Ethereum is a distributed computer, but it doesn’t have a keyboard and a monitor. It would be hard to play Call of Duty on the Ethereum Virtual Machine. But Ethereum’s blockchain and smart contracts can serve as sort of a back end to other types of programs. Developers build

or decentralized apps, on Ethereum and other blockchains. These are computer programs that mostly run on the web (perhaps on some centralized or cloud server) but keep some of their essential data on the blockchain. You play a computer game, and your character’s attributes are stored on the blockchain. A normal program on the game company’s servers renders the character’s sword on your screen, but the fact that she has the sword is stored on the blockchain.

One other limit is that it’s a slow computer. The way Ethereum executes programs is that you broadcast the instructions to thousands of nodes on the network, and they each execute the instructions and reach consensus on the results of the instructions. That all takes time. Your program needs to run thousands of times on thousands of computers.

Computers and network connections are pretty fast these days, and the Ethereum computer is fast enough for many purposes (such as transferring Ether, or keeping a database of computer game characters). But you wouldn’t want to use this sort of computer architecture for extremely time-sensitive, computation-intensive applications. You wouldn’t want, like, a self-driving car running on the Ethereum Virtual Machine. You wouldn’t want thousands of computers around the world redundantly calculating how far you are from hitting someone before you could brake.

ii. Proof of stake

This distributed computer, the Ethereum Virtual Machine, takes its basic design from Bitcoin. There are blocks, everyone can see them, they are chained together, transactions are signed with private keys, everything is hashed, etc. It’s just that, in addition to sending money to people, you can send computer instructions to the blockchain, and the blockchain will execute them.

What that means is that there are thousands of computers each running nodes of the Ethereum network, and all those computers will agree about what happens on that network, who sent money to whom, and what computer instructions executed when. The fact that Ethereum is a distributed, virtual computer means that all those actual computers can come to a consensus about what operations executed when. And the reason this was possible is that Bitcoin showed how a decentralized computer network could reach consensus. The stuff with the hashing and the mining and the nonces and the electricity: That is Bitcoin’s consensus mechanism, proof of work (or PoW).

Until last month, it was also Ethereum’s. There were some technical differences, but the basic mechanics were pretty similar. Miners did a bunch of hashes of block data, and whoever found the right hash first mined the block and got a reward. Because this was expensive and wasted a lot of resources, it demonstrated a commitment to the Ethereum ecosystem. But the waste itself was bad.

And so, on Sept. 15, after years of planning, Ethereum switched to a new consensus mechanism: Ethereum now uses something called proof of stake (or PoS). The basic ideas remain the same. People do transactions and broadcast them to the Ethereum network. A bunch of computers—in PoW they’re called “miners,” in PoS they’re called “validators”—work to compile these transactions into an official ordered list, called the blockchain. Anyone with a computer can be a miner/validator; the protocol is open to everyone. But the miners/validators have to prove their commitment to the system to mine/validate blocks. In PoW, the way you prove that is by using a lot of electricity to do hashes. In PoS, the way you prove that is by having a lot of Ether.

Oversimplifying a bit, the general mechanics are:

-

ANYONE CAN VOLUNTEER TO BE A VALIDATOR BY “STAKING” SOME OF THE NETWORK’S CURRENCY, DEPOSITING IT INTO A SPECIAL SMART CONTRACT. THE STAKED CURRENCY CAN’T BE WITHDRAWN FOR SOME PERIOD.26 ON ETHEREUM, YOU NEED TO STAKE 32 ETHER—CURRENTLY $40,000 OR SO—TO BE A VALIDATOR.

-

VALIDATORS GET TRANSACTIONS AS THEY COME IN AND COMPILE THEM INTO BLOCKS.27

-

AT FIXED INTERVALS (SAY, EVERY 12 SECONDS), ONE VALIDATOR IS RANDOMLY CHOSEN TO PROPOSE A BLOCK, AND SOME OTHER SET OF VALIDATORS IS CHOSEN TO REVIEW THE PROPOSED BLOCK AND VOTE ON IT.

-

THE RANDOMLY CHOSEN VALIDATORS AGREE ON WHETHER TO ADD THE BLOCK TO THE CHAIN. IF EVERYONE IS DOING THEIR JOB HONESTLY AND CONSCIENTIOUSLY, THEY’LL MOSTLY AGREE, AND THE BLOCK WILL BE ADDED.

-

THE VALIDATORS GET PAID FEES IN ETHER.

-

IF A VALIDATOR ACTS DISHONESTLY OR LAZILY—IF IT PROPOSES WRONG BLOCKS, OR IF IT FAILS TO PROPOSE OR VOTE ON BLOCKS, OR IF SOMEONE TURNS OFF THE COMPUTER RUNNING THE VALIDATOR—IT CAN HAVE SOME OR ALL OF ITS STAKE TAKEN AWAY AS A PENALTY.

I mean, that’s the concept, but when I write it out like that, it sounds more manual than it is. Nobody is sitting around reviewing every transaction and agonizing over whether it’s legitimate. The validators are just running the official open-source Ethereum software. It is all pretty automatic, and you can run it on a laptop with good backup power and a solid internet connection. The big outlay may be the $40,000 to buy Ether. It’s not hard to contribute to the consensus. It’s hard to override it. But being an honest validator is pretty easy.

When we discussed proof-of-work mining, I said that crypto systems are designed to operate on consensus among people with an economic stake in the system. PoW systems demonstrate economic stake in a cleverly indirect way: You buy a bunch of computer hardware and pay for a lot of electricity and do a bunch of calculations to prove you really care about Bitcoin. PoS systems demonstrate the economic stake directly: You just invest a lot of money in Ethereum and post it as a bond, which proves you care.

Making coins is a lot of work.

This is more efficient, in two ways. First, it uses less electricity. Burning lots of electricity to do trillions of pointless math calculations a second, in a warming world, seems dumb. Proof of stake uses, to a first approximation, no electricity. You’re simply keeping a list of transactions, and you just have to compile the list once, not 200 quintillion times. The transition to PoS cut Ethereum’s energy usage by something like 99.95%.

Second, PoS more directly measures your stake in the system. You demonstrate your stake in Ethereum by 1) owning Ether and 2) putting it at risk28 to validate transactions. To take control of the PoS system and abuse it for your own nefarious purposes, you need to own a lot of Ether, and the more you own, the less nefarious you’ll want to be. “Proof of stake can buy something like 20 times more security for the same cost,” Vitalik has argued.

• Staking

Here’s how a Bitcoin miner makes money:

-

Spend dollars to buy computers and electricity.

-

Use the computers and electricity to generate Bitcoin.

-

Sell the Bitcoin, or hold them and hope they go up.

Here’s how an Ethereum validator makes money:

- Buy Ether.

- Lock it up.

- Get paid fees in Ether that are, roughly, a percentage of the Ether you’ve locked up. Currently the fees are around 4%.

There’s still some computer hardware involved—you have to run software to compile and check transactions—but not much of it; again, it can be a laptop. The capital investment isn’t in computers but in the relevant cryptocurrency. The transaction is very close to: “Invest a lot of cryptocurrency and then get paid interest on that cryptocurrency.”

You can make it even easier on yourself. Instead of downloading the software to run a full Ethereum validator node, and depositing 32 Ether, you can hand your Ether over to someone else and let them be a validator. It doesn’t need to be 32 Ether: If you have 1 Ether, and 31 other people each have 1 Ether, and you all pool your Ether together, then you have enough to stake, validate transactions, and earn fees. And then you each can have a cut of the fees. The work of validating transactions can be completely separated from the actual staking of Ether.

And in fact a lot of Ethereum validation runs through crypto exchanges such as Coinbase, Kraken, and Binance, which offer staking as a product to their customers. (The biggest is a thing called Lido Finance, which isn’t an exchange but a sort of decentralized staking pool.) The customers keep their Ether with the exchange anyway, so they might as well let the exchange stake it for them and earn some interest.

Yes: interest. If you’re putting crypto into a staking pool, what it looks like to you is simply earning interest on your crypto: You have 100 tokens, you lock them up for a bit, you get back 103 tokens. The stuff about validating transactions occurs in the background, and you don’t really have to worry about it. You just get a percentage return on your money—around 4% now, but maybe less after fees—from locking it up. (Before you compare that to the passive income you might earn on, say, a bond, remember this is paid in volatile Ether.)

Crypto has found a novel way to create yield. We’ll talk about others later—crypto has a whole business of “yield farming”—but this is one. You can deposit your crypto into an account, and it will pay you interest. It will pay you interest not for the reason banks generally do—because they’re lending your money to some other customer who will make use of it—but because you are, in your small way, helping to maintain the security of the transaction ledger.

iii. Gas

Another difference between Ethereum and Bitcoin is that transaction fees are much more important in Ethereum.

The basic reason is that every transaction in Bitcoin is more or less the same: “X sends Y Bitcoin to Z.” In Ethereum, though, there are transactions like “Run this complicated computer program with 10,000 steps.” That takes longer. Thousands of nodes on the Ethereum network have to run and validate each computational step of each contract. If a contract requires a lot of steps, then it will use a lot more of validators’ time and computer resources. If it requires infinite steps, it would crash the whole thing.

To address this issue, Ethereum has “gas,” which is a fee that people and smart contracts pay for computation. Each transaction specifies 1) a maximum gas limit (basically a number of computational steps) and 2) a price per unit of gas. If the transaction uses up all its gas—if it takes more steps to execute than the gas limit—it fails (and still pays the gas fee). This deters people from sending superlong transactions that clog the network, and it absolutely prevents them from clogging the network forever.

In early Ethereum, the gas fees, as well as built-in mining rewards, were paid to the miner who mined a block. Since the move to PoS, the built-in rewards are lower (because it’s much less expensive to be a validator than a miner, so you don’t need to get paid as much). And now some of the gas fees are “burned” (the Ether just vanishes) instead of being paid to validators. The basic result is that Ether as a whole is paying less for security under PoS than it used to.

There are still gas fees, though, and some of them still go to validators. And generally speaking, the more you offer to pay for gas, the faster your transaction will be executed: If Ethereum is busy, paying more for gas gets you priority for executing your transactions. It is a shared computer where you can pay more to go first.

iv. Tokens

● ERC-20

One thing a smart contract can do in Ethereum is create new cryptocurrencies. These cryptocurrencies are generally called “tokens.”

Why would you want to do this? One reason we already talked about:

-

You can make up an arbitrary token that trades electronically.

-

If you do that, people might pay a nonzero amount of money for it.

-

Worth a shot, no?

This is extremely easy to do in Ethereum. (The Ethereum white paper includes a four-line code snippet “for implementing a token system” on Ethereum.) And so there’s the Shiba token, which calls itself “a decentralized meme token that evolved into a vibrant ecosystem.” It’s Dogecoin but on Ethereum, easy. It has a “Woof Paper.”

But there are lots of other reasons to create cryptocurrencies. If you set up some sort of app that does a thing on the Ethereum system and you want to charge people money for doing that thing, what sort of money should you charge them? Or if you set up a two-sided marketplace that connects people who do a thing with people who want the thing done, what sort of money should the people who want the thing use to pay the people who do the thing?

Dollars are a possible answer, though an oddly hard one: US dollars don’t live on the blockchain, but in bank accounts. Ether is the most obvious answer: You’ve set up an app in Ethereum, so you should take payment in the currency of Ethereum. But a persistently popular answer is: You should take payment in your own currency. People who add value to your service should be paid in your own special token; people who make use of the service should pay for it in that token. And then if the service takes off, the token might become more valuable.

An asset class?

We’ll discuss this idea in more detail later. For now, I’ll just say that Ethereum has a standard for how these sorts of tokens should be implemented, and it’s called ERC-20. And when there are decentralized apps on the Ethereum blockchain, there’s a good chance that they’ll say they have an ERC-20 token.

One essential property of an ERC-20 token is that it’s fungible—like dollars, or Bitcoin, or Ether. If I create an ERC-20 token called Mattcoin and mint a billion Mattcoins, each of those billion tokens works exactly the same and is exactly interchangeable. They all trade at the same price, and nobody wants, or gets, any particular identified Mattcoin.

● ERC-721

There’s another way to do a token, though. You could have a series of tokens, each with a number. Token No. 1 in the series is different from Token No. 99, in the sense that Token No. 1 has the number 1 and Token No. 99 has the number 99. This is generally referred to as a nonfungible token, or NFT. The most popular Ethereum standard for NFTs is called ERC-721, and you’ll see that name sometimes.

Let me quote a bit of the ERC-721 standard:

The ERC-721 introduces a standard for NFT, in other words, this type of Token is unique and can have different value than another Token from the same Smart Contract, maybe due to its age, rarity or even something else like its visual. Wait, visual?

Yes! All NFTs have a [numerical] variable called tokenId, so for any ERC-721 Contract, the pair contract address, [numerical] tokenId must be globally unique. That said, a dapp can have a “converter” that uses the tokenId as input and outputs an image of something cool, like zombies, weapons, skills or amazing kitties!

Look how minimal this standard is, despite the zombies and kitties. An NFT consists of a series of numbered tokens, and the thing that makes it an NFT is that it has a different number in its tokenId field from the other tokens in its series.

If you’d like to imagine that this different number makes it something cool, like a zombie, or a kitty, you can! Go right ahead! Or if there’s a computer program—or an Ethereum dapp—that looks at your number and says, “Ah, right, this number corresponds to a zombie with green hair and a fetching scar on his right cheek,” then the computer program is free to say that—and even serve you up a picture of that zombie—and you are free to believe it.

We’ll come back to this.

IT GETS WEIRD.

v. An ICO

Here’s another important difference between Ethereum and Bitcoin. Bitcoin never raised money; Ethereum did.

You can think of Bitcoin as more or less the open-source passion product of one anonymous guy who really likes cryptography. The cost of building the basic system of Bitcoin was Satoshi’s time, which he donated. Then he mined the first Bitcoins and got super rich, probably, but that came later.

Ethereum was a bit more complicated to build. Vitalik Buterin is the intellectual leader of Ethereum, but there were a bunch of co-founders. There were legal entities. There were programmers. They spent a lot of time on it. They had to pay for food deliveries.